BtcTurk, Turkey’s second-largest cryptocurrency exchange, has become the latest casualty in a brutal summer for digital asset platforms. The exchange suffered a multi-chain hot wallet breach on August 14, resulting in an estimated $48–$50 million in losses.

The attack compounds what has already been a devastating season for the crypto industry — over $142 million was stolen in July alone, and this latest incident pushes the summer’s tally toward $200 million.

How the Hack Unfolded

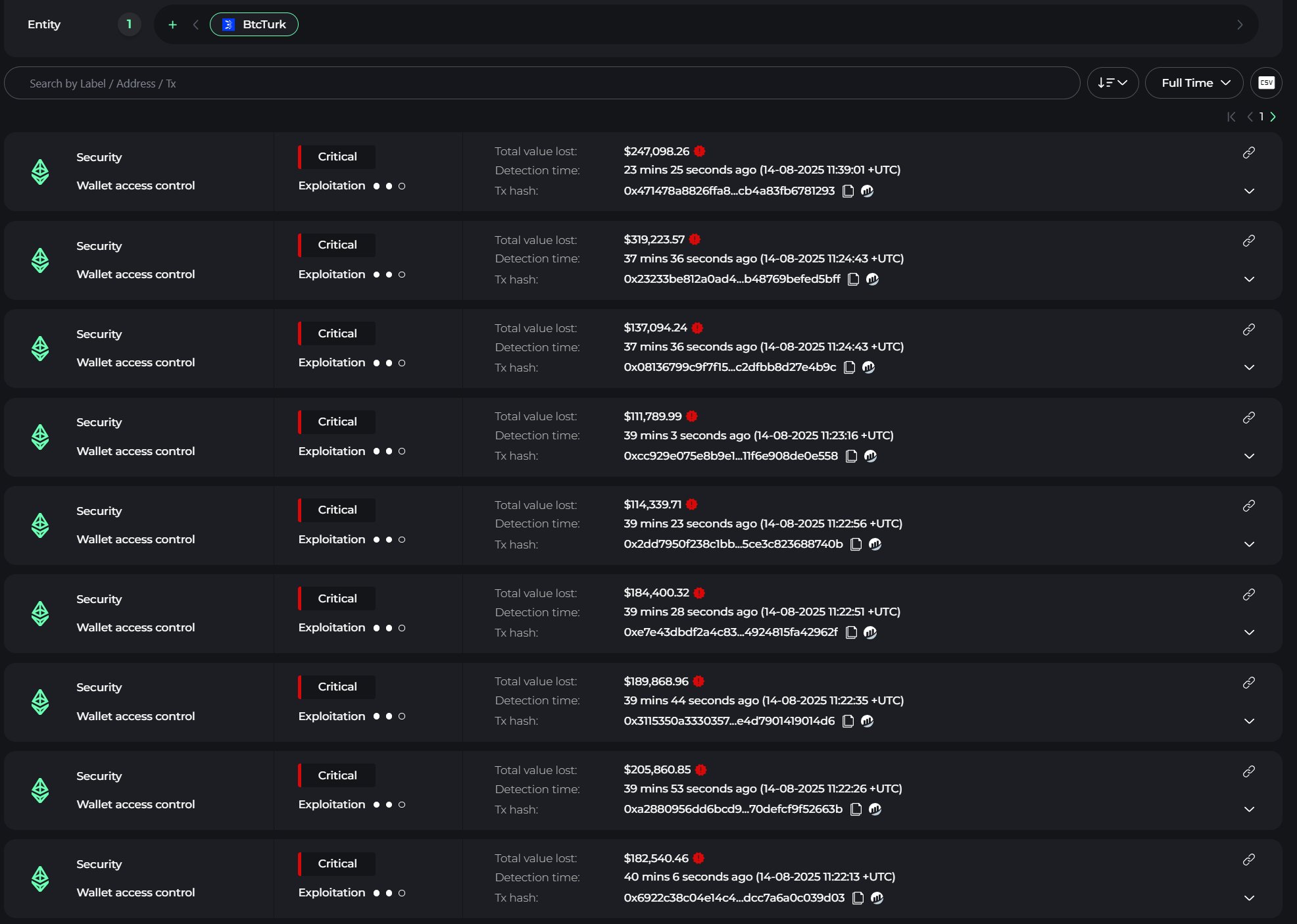

Blockchain security firm Cyvers first flagged suspicious activity after detecting a series of large withdrawals from BtcTurk’s hot wallets across Ethereum, Avalanche, Arbitrum, Base, Optimism, Mantle, Polygon, and Solana.

Within minutes, the attacker consolidated funds into just a few wallets before rapidly swapping them for Ethereum, a well-known laundering tactic that makes recovery far more difficult.

Additional blockchain analysis revealed the hacker’s movements:

- Over $34 million in ETH was spread across two Ethereum wallets.

- Solana-based tokens — including meme coins like MELANIA, TRUMP, PYTH, WIF, PENGU, and PUMP — were routed through a wallet tagged as “PNUT Whale” before being parked in a final address with $6.09 million in assets.

- The attacker also targeted BNB Chain assets, swapping them via PancakeSwap and even using MetaMask swaps for speed.

Despite halting user deposits and withdrawals, the compromised wallet continued sending tokens to attacker-controlled addresses, suggesting the hacker had full control of its private keys.

BtcTurk’s Response

BtcTurk acted quickly to contain the damage, freezing cryptocurrency deposits and withdrawals while keeping trading between crypto and Turkish Lira active.

In a translated statement, the exchange assured users that:

“The vast majority of digital assets are securely stored in cold wallets, which remain unaffected. Thanks to BtcTurk’s solid financial position and security measures, customer assets are safe.”

BtcTurk also reported that official authorities have been notified, and a full investigation is underway. However, experts like Xuxian Jiang, CEO of PeckShield, warned that the chances of recovering the stolen funds are low unless negotiations with the attacker occur — a strategy that has had mixed results in past cases.

Hot Wallets: A Persistent Risk

Hot wallets — internet-connected storage solutions for crypto — are essential for exchanges to handle withdrawals and trading liquidity. However, their constant online exposure makes them prime targets for cybercriminals.

Cold wallets, in contrast, store private keys offline and are far more secure but lack the convenience required for daily exchange operations. For BtcTurk’s 6 million registered users, both systems are critical — and both must be protected.

A Summer of Crypto Breaches

The BtcTurk incident is part of a troubling trend:

- CoinDCX lost $44 million in July to a malware attack.

- GMX suffered a $42 million exploit, though most funds were later returned.

- BigONE and WOO X were hit for $28 million and $12 million, respectively.

According to PeckShield, July’s $142 million in stolen funds represented a 27% increase from June. With the addition of BtcTurk’s $48 million loss, the total summer damage nears $200 million — a sobering figure for an industry already grappling with declining trust.

The Bigger Picture

This latest breach raises serious questions:

- Can exchanges ever fully secure themselves from determined attackers?

- Should the industry adopt stricter wallet segregation or multi-signature requirements for hot wallets?

- Is regulatory oversight inevitable if hacks keep escalating?

Until these systemic issues are addressed, multimillion-dollar crypto heists are likely to remain a regular occurrence — eroding user confidence and slowing mainstream adoption.

For now, BtcTurk users can only wait as forensic teams trace the stolen assets and authorities pursue the attacker. History suggests that most of these funds may never be recovered, but the incident will almost certainly add urgency to the global conversation about crypto security.

Bottom line: The BtcTurk hack is not an isolated case — it’s another chapter in crypto’s ongoing struggle with security. And unless the industry makes bold, structural changes to how exchanges store and protect assets, the next $50 million breach may already be on the horizon.